This article aims to provide insights into the revenue recognition process of subscription-based businesses. Firstly, we will explain the ASC 606 standard. Then, we will delve into common terminology. Lastly, we will discuss various scenarios that are common sources of issues.

ASC 606

Given the relative complexity of correctly recognising subscription revenue, several companies, particularly younger ones, find this topic challenging and confusing. This leads to issues of inconsistencies (and sometimes outright mistakes), prompting the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) to collaborate on developing a solution. Together, they created ASC 606, a framework for recognising revenue for subscription-based services.

The framework consists of five steps:

- Step 1: Identifying the customer’s contract

- Step 2: Identifying the contractual performance obligations

- Step 3: Determining the overall price for the contract

- Step 4: Allocating the transaction price to the contractual obligations

- Step 5: Recognising revenue when the performing party satisfies the performance obligations

Let’s take an example. Suppose a customer orders a one-year subscription for $1,200 on January 1st ’23:

- Step 1: The contract is formed when the customer agrees to the terms and conditions

- Step 2: The performance obligation lasts for one year, starting on January 1st ’23, and ending on December 31st ’23

- Step 3: The transaction price is $1,200, which represents the amount paid for the annual subscription

- Step 4: Since the contract period is 365 days and revenue needs to be recognised daily, $1,200 / 365 days = $3.29 of revenue is allocated to each day

- Step 5: At the end of each month, revenue is recognized based on the number of days in the month. For instance, for January, revenue of $3.29 * 31 days = $101.99 would be recognized based on 31 days in the month

This simple example illustrates how the framework can guide the recognition of revenue. However, in reality, this process becomes harder and harder to manage as the number of subscriptions (and their scenarios) grows.

In the following section, we will explore common terms to help define a shared language.

Common Terminology

Let’s start by defining some common terms before we explore different scenarios within subscription businesses:

- Bookings refer to the actual sale that is recorded in your records, usually in a CRM. A signed sales order from a customer is often considered a “booked deal,” and the date of signature indicates when the booking occurred (e.g., Jan 1st ’23). This is a useful leading indicator for the revenue that will be recognised in the future

- Billings occur when customers are invoiced for the services provided. In best-case scenarios, billing occurs at the same time as the booking and with multi-year, annual or quarterly prepayments. This creates significant advantages for a company’s cash flow, since the more the company grows, the more cash it collects. In other less ideal cases, billing can happen later, for example after onboarding. This poses a higher risk for the business, because cash will be collected later, and in the meantime, the customer could default on payments (resulting in Bad Debt)

- Deferred Revenue is revenue that is received upfront but has not yet been earned. Many subscription businesses bill their customers upfront for several months or years at once. The revenue is recorded as a liability in a Deferred Revenue account on the balance sheet

- Subscription Revenue is the revenue recognized on the Income Statement each month. It is the revenue that has been earned during the month and is derived from the Deferred Revenue schedule. Revenue is a critical number for investors as it indicates the strength of the business

Other common terms in SaaS include Annual Recurring Revenue (ARR), Average Revenue Per Unit (ARPU), and Monthly Recurring Revenue (MRR). These are related to revenue but are not the same, as they generally are used as a leading indicator for revenue.

Scenarios: Billing Cycles, Bundles, Upgrades, Downgrades, Cancellations

Let’s start by looking at how different billing cycles affect Deferred Revenue.

Annual Billing

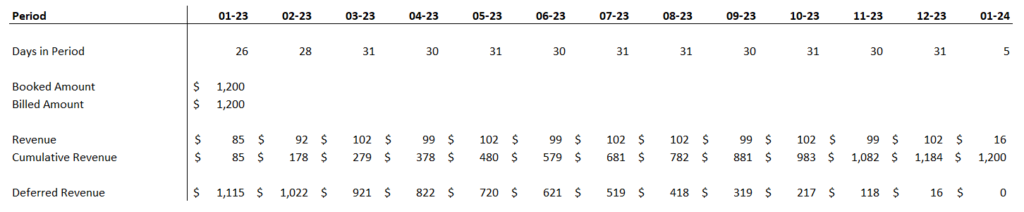

Let’s assume a customer order was signed on Jan 5th ’23, for an annual subscription of $1,200.

In this case, we only recognise 26 days in Jan ’23, since the order was signed on Jan 5th ’23. Also, the subscription ends a year later in Jan ’24, leaving some revenue to be recognised in that month.

Quarterly Billing

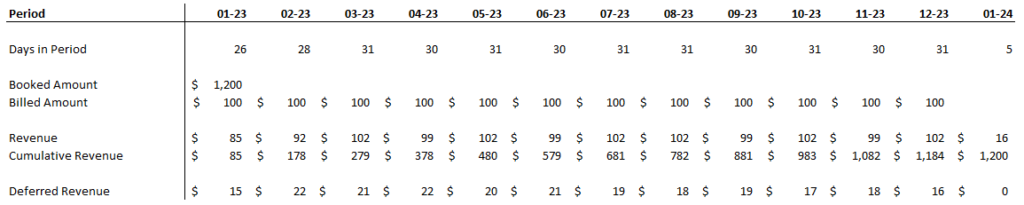

Let’s assume the order was signed on Jan 5th ’23, for an annual subscription of $1,200. However, the customer opted for quarterly billing.

In this case, the Deferred Revenue balance goes up as new payments come in every quarter.

Monthly Billing

Let’s assume the order was signed on Jan 5th ’23, for an annual subscription of $1,200. However, the customer opted for monthly billing.

In this case, Deferred Revenue is very small, since it only accounts for the number of subscription days that roll over into the next month.

Now that we looked at some nuances of Billing Cycles, let’s turn our attention to Bundles.

Bundles

It’s common to offer a discount when customers buy multiple subscriptions at once. For example, a company may offer a 10% discount on the overall price should a customer buy an additional subscription on top of the existing one starting on Jan 25th ’23 for $1,200.

So let’s assume the customer buys a second annual subscription starting on Jan 25th ’23 for $600. The total value for the subscriptions is $1,200 + $600 = $1,800, but we apply a 10% discount, bringing it down to $1,800 – ($1,800 * 10%) = $1,620.

Now, the question is, how do we account for the discount? Whilst on the customer invoice this may appear as a standalone item, it’s best for internal purposes to pro-rate the discount to the two subscriptions. This means effectively recognising a total of $1,200 * ($1,200 * 10%) = $1,080 for the first annual subscription and $600 * ($600 * 10%) = $540 for the second subscription, for a total of $1,620. This is appropriate to avoid ending up with a general “Discount” line, and instead allocate the discount to the products it belongs to.

Upgrades, Downgrades and Cancellations

Customers may want to upgrade their existing subscription to a higher-priced option. In this case, we follow this process:

- We “reset” the Deferred Revenue schedule by refunding the remaining Deferred Revenue balance of the existing subscription

- We charge the price for the new subscription, pro-rated for the days remaining under the existing contract

- Usually, the customer is charged the net difference between the refund of the existing Deferred Revenue balance and the price of the new subscription

Customers may also want to downgrade their existing subscription to a lowered-priced option. In this case, we will follow the same process above, with the only difference being that the process will result in an actual refund to the customer. A lot of companies only allow upgrades within the duration of the existing contract.

A different process takes place in case of cancellations, which can be split into cancellations with or without refunds. If a refund takes place, the entire remaining Deferred Revenue balance is paid back to the customer. In case there is no refund, all the remaining Deferred Revenue should be recognised in the cancellation month.

Although these are the most common scenarios, there are a lot of others. For example, cases in which a cancellation includes a refund of the entire subscription, therefore including revenue that was already recognised. Or when a company won’t start a subscription term until the customer is successfully onboarded. These cases require more attention and solid processes to manage them consistently.

Revenue Recognition at Scale

The standards described above are fairly complex to understand and manage correctly even just for a handful of customers. Imagine now managing these changes daily for dozens, hundreds or thousands of customers. It becomes nearly impossible to manage manually revenue recognition at scale. Fortunately, there are several great softwares that automate not only revenue recognition but the entire “Order to Cash” process, including invoicing, payments, accounts receivable, reporting, and more. Some of the most known are Chargebee, SaaS Optics (now Maxio) and Recurly.

The sooner one implements an automated system, the more reliable the company’s data will be, which is essentially not only from a compliance point of view but also to make decisions based on a truthful view of the business performance.