Every software founder dreams of achieving a high valuation. However, understanding what truly drives that valuation can make the difference between a good exit and an outstanding one.

While many founders view ARR or EBITDA as the key indicator, savvy investors and CFOs often prioritize another metric: gross profit.

Let’s explore why gross profit often holds more strategic value and how both metrics interplay, especially in a world increasingly reshaped by AI.

1. Gross Profit: Your Long-term Valuation Anchor

What is Gross Profit?

Gross Profit = Revenue – Cost of Goods Sold (COGS).

This metric captures the direct costs of delivering your software or service, including hosting, payment processing, customer support, and direct software costs.

It is a direct reflection of your business model’s efficiency: gross profit tells you how much cash you have left after delivering your service, but before building anything new or selling it. That leftover margin powers the engine: it funds R&D, sales, and growth.

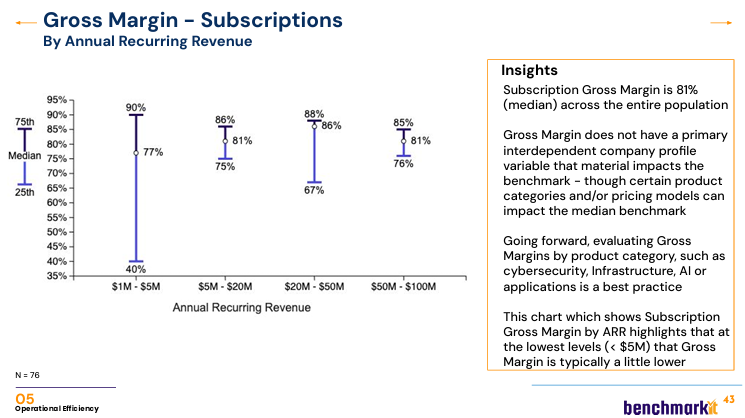

Healthy gross margins for software subscriptions typically fall between 70% to 90%, depending on the company size and stage.

Source: 2025 B2B SaaS Performance Metrics Benchmarks, Benchmarkit.

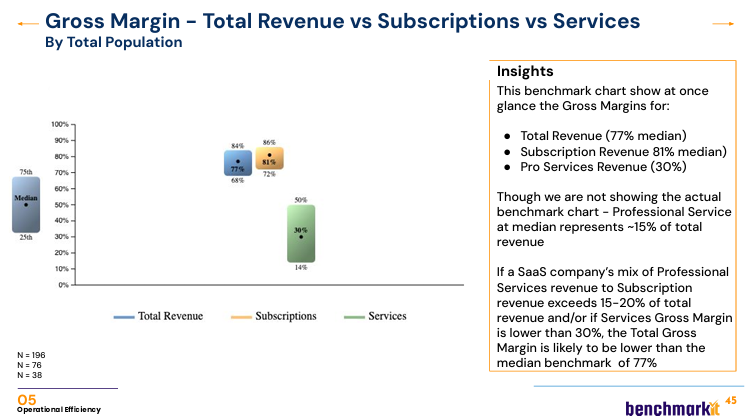

Gross profit is best analyzed by revenue stream. Gross margins for software subscriptions are typically much higher than those for professional services.

Source: 2025 B2B SaaS Performance Metrics Benchmarks, Benchmarkit.

How AI Changes Expectations:

AI-heavy products often come with non-trivial inference costs, heavier GPU infrastructure, and opaque margins. Founders often underestimate this early on – but investors won’t. They’ll expect you to control these costs at scale, or price accordingly.

At the same time, leveraging AI-driven automation can significantly lower direct costs (e.g. customer support), driving gross margins higher. Investors increasingly expect higher gross profit margins from companies effectively integrating AI solutions, viewing lower margins skeptically as signs of potential inefficiencies.

2. EBITDA: A Universally Accepted Metric

What is EBITDA?

EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization.

In simple terms: it’s revenue minus all operating expenses, excluding capital and financing costs.

EBITDA reflects operational profitability. It shows whether you can turn revenue into cash without fancy accounting tricks. It’s often used in valuation multiples for bootstrapped or PE-backed companies.

Typical software EBITDA margins range broadly from 10%-50%+, heavily influenced by market conditions, growth stages, and reinvestment strategies.

AI-driven efficiencies not only boost gross profit but can substantially improve EBITDA by optimizing operational costs, automating routine tasks, and enhancing productivity.

However, because EBITDA is more easily influenced by short-term decisions, its improvement might not indicate a sustainable competitive advantage.

3. Why Gross Profit Holds More Weight Than EBITDA in Valuation

Here’s the key insight:

Gross profit changes are structural. EBITDA changes are managerial.

Gross profit reflects how your product is built and delivered. Fixing a weak gross margin usually means redesigning pricing, reworking infrastructure, or rebuilding delivery – hard things to change fast.

Investors perceive higher gross margins as indicative of robust, scalable, and resilient business operations capable of enduring economic fluctuations.

EBITDA, on the other hand, is easier to manipulate: slash marketing spend, pause hiring, optimize G&A. A new investor can restructure costs post-acquisition and boost EBITDA with levers you’ve left on the table.

That’s why acquirers – and savvy investors – often care more about gross margin. It’s harder to fake and more indicative of long-term value.

Takeaways for Software Founders

Focus your strategy on improving gross profit margins for long-term valuation impact. Ensure your business model optimizes costs directly associated with revenue generation. AI investments can significantly help here.

While EBITDA matters, investors ultimately value companies capable of demonstrating consistent, scalable profitability. By prioritizing gross profit, you’ll position your company for a higher, more sustainable valuation.

Conclusion

In summary, while EBITDA provides a snapshot of operational efficiency, gross profit is the real foundation of your company’s long-term valuation. Embrace strategies that sustainably boost gross margins – particularly AI-driven innovations – and watch your company’s valuation climb.