Scaling a software business often feels like balancing on a tightrope. Founders know they need to invest in growth, but how much should they really spend – and where?

Too much spending on Sales and Marketing (S&M) could mean burning through cash without returns. Too little R&D risks losing the innovation edge. Overweight General & Administrative (G&A) costs can erode your agility and dilute profitability.

Getting this balance right is critical not only for maintaining growth but also for profitability and sustainable margins.

Recent benchmarks from the 2025 B2B SaaS Performance Metrics (Benchmarkit, May 2025) shed light on how successful companies allocate spending across these key departments, depending on their size, funding source, and pricing model.

Let’s unpack these insights in a practical, actionable way.

Sales & Marketing: The Shifting Priority

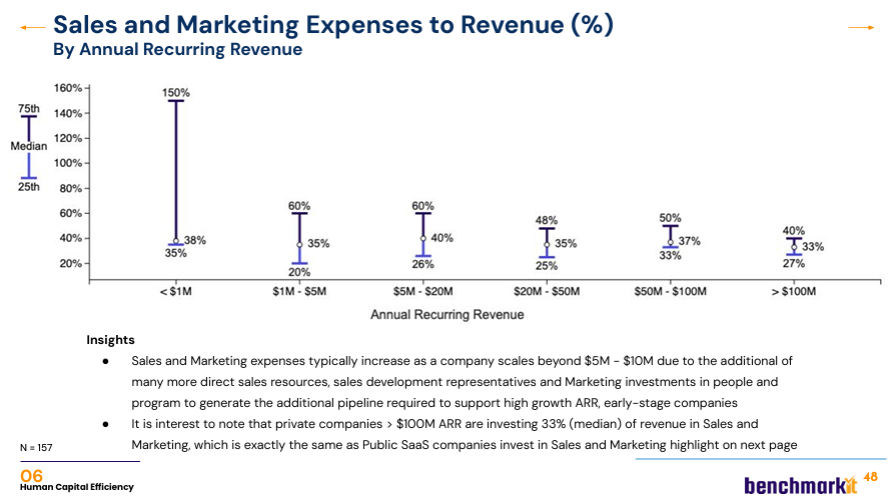

When you’re early-stage (less than $1M ARR), S&M naturally dominate your budget. You’re in land-grab mode – each dollar should directly drive customer acquisition and expand your market footprint.

Early-stage companies commonly spend large portions of their revenue on S&M. This can be alarming, but is usually essential to establish product-market fit and boost early brand recognition.

Yet, as you mature and cross key revenue thresholds, the spending dynamics shift significantly. Expansion and upselling within your current customer base become more cost-effective than chasing new customers, driving median S&M spending dramatically downward.

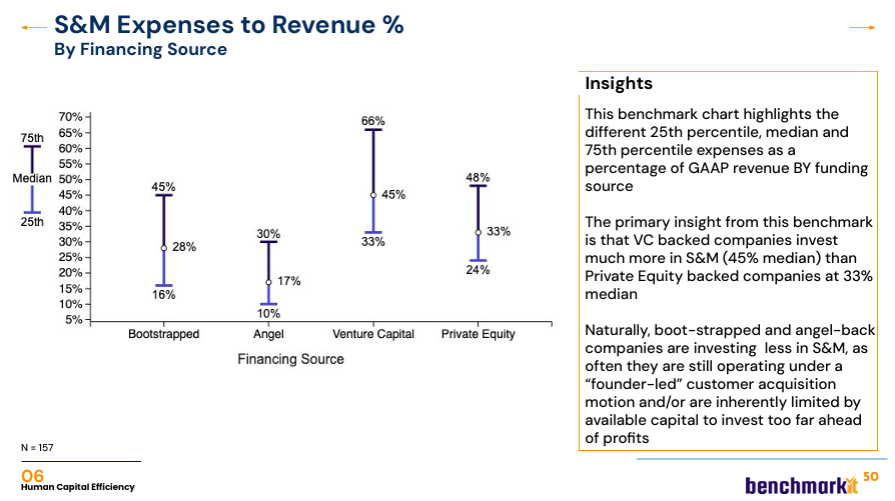

Interestingly, your funding source significantly impacts your S&M budget decisions. Venture-backed companies typically remain aggressive, with a median spend of around 45% of revenue on S&M. In contrast, private-equity-backed firms tend to be more conservative, spending around 33%, reflecting tighter operational discipline, a greater emphasis on profitability, and shorter CAC payback periods. Bootstrapped businesses are even more efficient, spending around 28%.

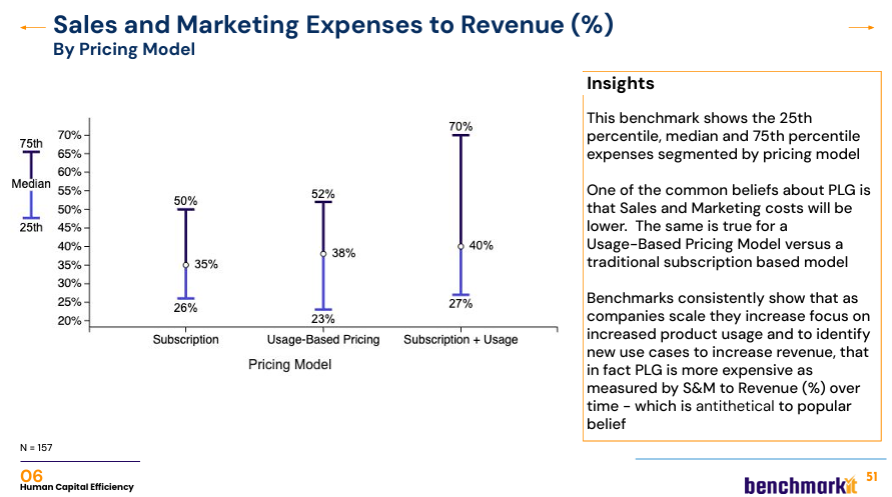

Another key insight lies in pricing models: Product-led and usage-based businesses often assume lower-touch sales motions mean lower marketing expenses. However, benchmarks reveal the opposite: these models frequently spend even more aggressively to convert free users into paying customers, often surpassing traditional subscription companies.

Clearly understand how your financing and go-to-market strategy shape your ideal S&M spend trajectory. If you’re venture-backed, higher early spending can be justified. If profitability is your primary goal, ensure spending discipline tightens predictably as you scale.

R&D: Investing Smartly in Innovation

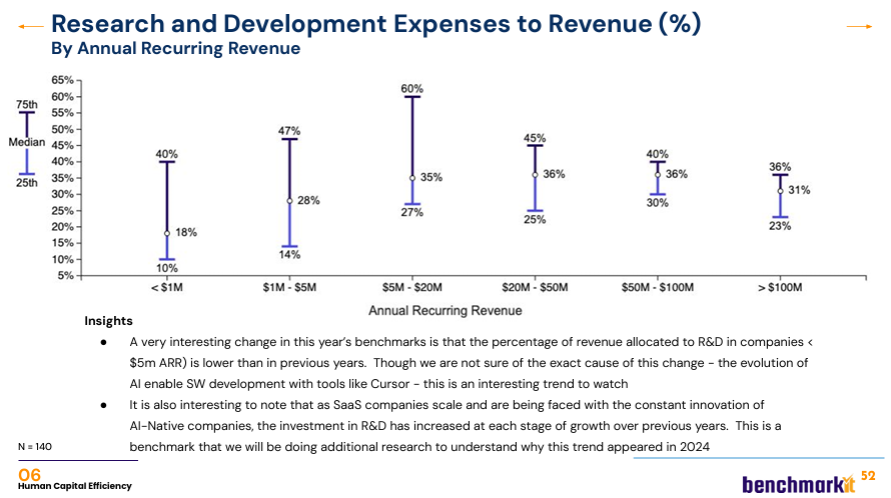

R&D spending offers a compelling narrative. Early-stage companies now manage leaner R&D budgets thanks to more accessible AI tools, no-code platforms, and rapid prototyping technologies. However, as companies reach moderate scale, R&D investments rise, typically to about 35% of revenue. At this stage, product differentiation and continuous innovation become essential for maintaining competitive advantage, with substantial investment directed toward AI integrations and advanced product ecosystems.

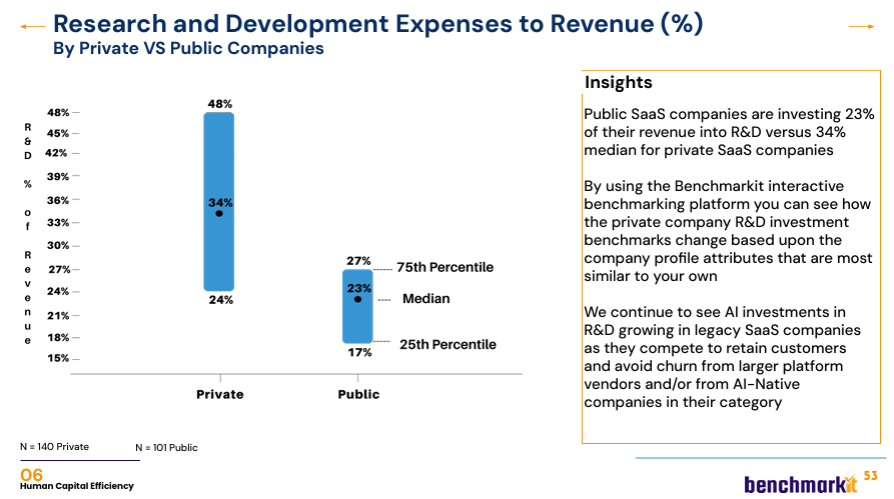

Notably, private software firms invest more aggressively (median 34%) compared to public companies (23%). Private firms frequently aim for strong product differentiation to position themselves favorably for exits or acquisitions, while public firms prioritize short-term profitability and operational efficiency.

Treat your R&D budget as a strategic investment portfolio. Allocate carefully between maintaining core product strengths and funding experimental projects directly linked to customer value or clear competitive differentiation. Uncontrolled R&D spending can quickly erode profitability, so manage innovation with clear performance benchmarks and scalability in mind.

General & Administrative: Efficiency as a Profit Lever

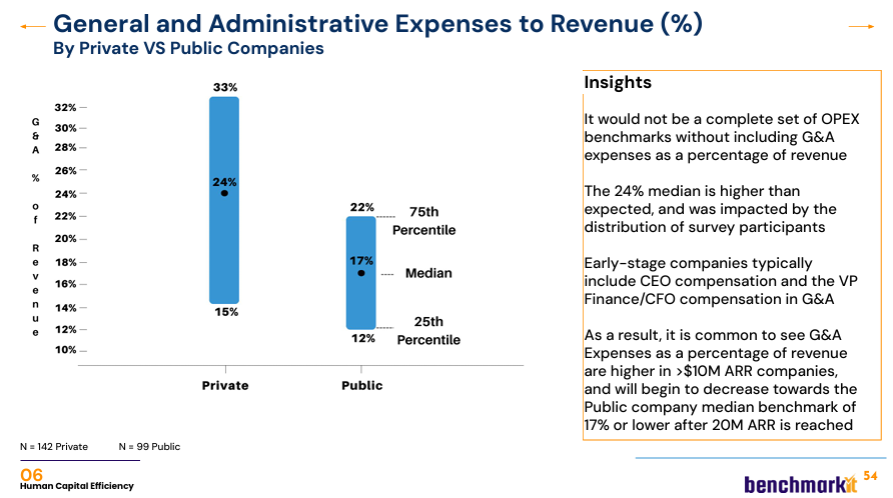

G&A spending might not grab headlines like new customer acquisition or innovative product launches, but it’s pivotal for profitability. Early-stage companies often experience inflated G&A expenses (around 25–30%) due to overhead, founder compensation, and initial administrative hires. As companies grow and their ARR increases, economies of scale become evident. Automation, improved software tooling, and centralized administrative services bring median G&A spending down significantly, approaching public company norms (~17%).

Reducing G&A directly boosts operating margins, making it a potent lever for profitability. Every percentage point trimmed from G&A frees resources that can bolster margins or be redeployed into growth-driving activities like S&M or R&D.

Aggressively automate and streamline operations early to achieve significant cost savings later. Investing proactively in operational efficiency often offers easier wins for margin enhancement compared to accelerating growth initiatives.

Conclusion: Finding Your Own Balance

Every software company faces unique market conditions, growth ambitions, and funding realities. While industry benchmarks provide critical guidance, effective budgeting must consider your specific context: customer acquisition efficiency, product complexity, funding strategy, and overall growth objectives.

Still, a clear roadmap emerges for founders navigating their scaling journey:

- Early-stage: Invest aggressively in S&M to capture market share.

- Growth-stage: Increase strategic R&D investment to differentiate and remain competitive, especially through targeted AI integration and innovation.

- Mature-stage: Optimize G&A through automation and process efficiency to drive profitability and margin improvement.

Ultimately, successful budgeting isn’t about blindly following averages or medians – it’s about deeply understanding why these spending patterns evolve. Founders who internalize these insights can confidently balance growth aspirations with profitability demands, making informed trade-offs along the way.

The journey from early-stage hustle to mature-stage discipline demands strategic clarity. Companies mastering this balance don’t just grow – they scale sustainably, creating lasting competitive advantage and long-term value.