Most B2B SaaS founders have considered exiting their company at one time or another. If your ARR is under $100M, an IPO is usually out of reach, which leaves two main options:

-

- Sell the business

- Install new management and retire

Today, we’ll focus on the first option.

Is Now A Good Time To Sell?

Making this decision raises many critical questions:

-

- Are we, as founders, emotionally ready to move on from our project?

-

- Have we reached a level of maturity where further improvements would only be incremental?

-

- Is it time to cash in on some or all of the equity tied up in the business and move on to something else?

-

- What if we’re selling too early?

Because many of these considerations are unique to each company, this post focuses on external factors alone.

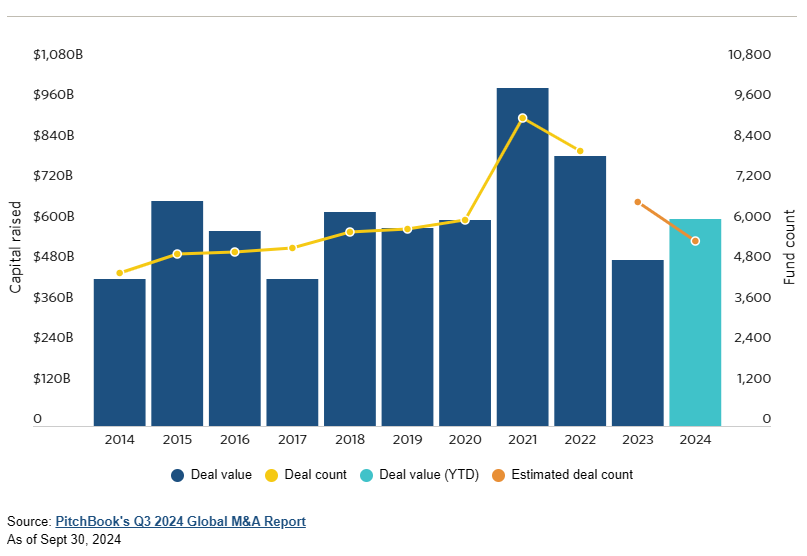

In 2021 and part of 2022, software M&A activity surged, driving valuations to unprecedented levels. Acquisitions by both strategic buyers and private equity funds increased sharply, and public enterprise software multiples followed suit—further inflating private valuations.

Deal Value and Deal Count

However, these prices have since fallen. As interest rates rose and investors adopted a “risk off” mindset, stock prices for public software companies declined. In 2023, M&A activity corrected, with public acquirers stepping back from deals and private equity firms recognizing that their own exit opportunities might be evaporating.

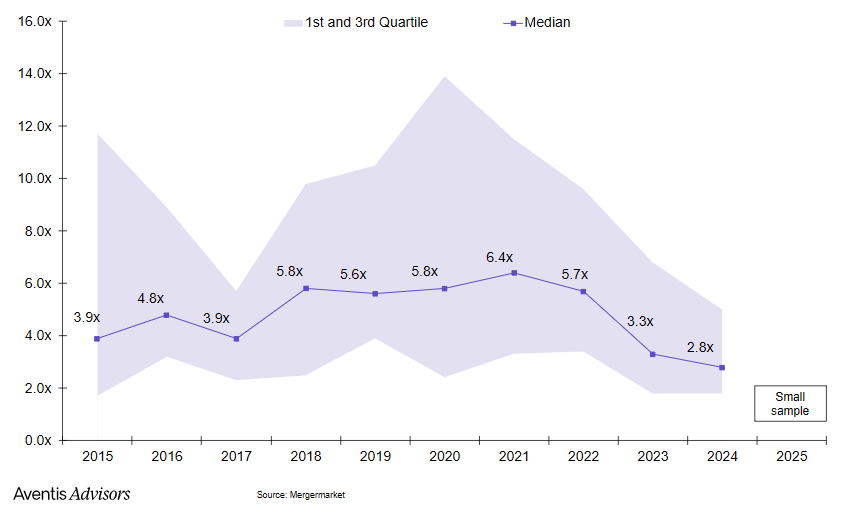

EV/Revenue Multiples

As a result, valuations are now lower: many mid-tier software companies (those not exceeding the Rule of 40) trade at just 1–5x ARR. Businesses surpassing the Rule of 40 generally fare better, but most do not reach that benchmark.

Selling at the moment could mean accepting an exit package that is only a fraction of what it might have been two or three years ago. However, timing the market is nearly impossible. Also, if you plan to reinvest your proceeds soon after selling, you could benefit from the same price discounts you had to concede as a seller.

Let’s assume you want to keep exploring. Where should you start?

Who Should I Sell To?

When considering the sale of your software business, you will typically encounter three primary categories of buyers: private equity funds focused on EBITDA, private equity funds focused on growth, and strategic acquirers. Each group values different traits in a target company, and understanding their priorities will help you determine the best fit.

-

- EBITDA-Focused PE Funds These buyers target profitable software companies, ideally those exceeding the Rule of 40. They place a premium on a balance of growth and profitability rather than on growth alone. In the current market, these funds may pay 10–20x EBITDA for companies meeting or exceeding the Rule of 40, while those falling short often command 5–10x EBITDA. If your software company is growing quickly but remains unprofitable, shifting toward profitability—often called “sprinting” to profitability—can improve your valuation significantly.

-

- Growth-Focused PE Funds These investors prefer high-growth software companies, even if they’re not profitable. They often acquire a minority stake—40–60%—and then fuel the company’s expansion before steering it toward profitability. While valuations for growth-oriented businesses were once very high, they have moderated. Strong companies showing more than 50% annual growth can still see multiples around 6–12x ARR, but 20% year-over-year growth is no longer compelling. A complicated cap table can also deter these buyers, as it suggests potential misalignment among stakeholders.

-

- Strategic Acquirers Strategics often generate the most buzz because they may pay significant premiums—sometimes 20–30x ARR—based on the synergies they foresee, whether from integrating new technology, acquiring strong teams, or unlocking cross-selling opportunities. However, strategic M&A activity has slowed as boards, investors, and regulators have become more cautious. Even so, if you can demonstrate clear synergies and a good cultural fit, a strategic buyer may still offer an attractive path.

After evaluating which type of buyer best suits your goals, what comes next?

How Do I Prepare?

Below are the key areas sophisticated acquirers generally scrutinize. Provide only what they request, and begin preparing these materials at least a couple of months before you formally start the process. If you are not already tracking these metrics, consider doing so immediately for the health of your business.

-

- Financial Statements Prospective buyers will always ask for financial statements. Ideally, you should have audited or unaudited statements ready from a reputable accounting firm, along with Trial Balances, General Ledger summaries, and bank statements.

-

- Customer Metrics: Churn, Retention, and Profitability Acquirers will look closely at MRR and ARR data—organized for cohort analysis—along with churn rates, net retention, and lifetime value (LTV), all segmented by factors like customer size or industry. They also want to understand the profitability of various customer segments after costs such as sales, support, and operations.

-

- Customer Acquisition Cost (CAC) and Funnel Metrics CAC often merits its own category. Buyers want a breakdown of lead sources (inbound, outbound, referrals, and paid) and funnel metrics to see if there is untapped potential. They also look at conversion rates and whether increased spending in certain channels could accelerate growth.

-

- Sales Efficiency For companies with a sales team, expect in-depth questions about sales cycles, average deal sizes, quota attainment, and the touchpoints required to close deals. Acquirers want to assess your unit economics—how many dollars of revenue and earnings you generate for each dollar spent on sales salaries.

-

- Product Usage and Feature Adoption Astute buyers will examine how actively customers use your software. Ideally, you should have data on the most frequently used features, as well as those that fell flat. High engagement can signal a strong product-market fit.

-

- Market Size and Opportunity Most buyers will inquire about total addressable market (TAM) and possible greenfield opportunities. Some will bring in external advisors to validate the market size. Having credible research and sound logic behind your growth forecasts can strengthen your negotiating position.

-

- Pricing If a PE firm probes your pricing structure, it often signals an intention to raise prices post-acquisition. Many founders set initial pricing early and rarely revisit it. Be ready to discuss which customers have discounts and where price increases might be possible.

Also prepare for questions about corporate structure, legal obligations, and contract terms. Staying organized in all these areas smooths the due diligence process and gives you stronger negotiating leverage.

Keep in mind that negotiations can be the most challenging part of the sale. This may be your first exit, and even if it’s your second or third, your counterparts specialize in these deals and have an entire organization behind them to optimize the process in their favour. It’s wise to enlist professional advice, even if you have prior experience.

What Does My Life Look Like After The Exit?

If you decide to leave the company and pursue other opportunities, you will likely still have a post-sale transition period. It’s not uncommon for part of your exit package to include an earn-out component tied to achieving post-sale metrics, typically measured over 6 to 18 months. This arrangement ensures a smoother handover for the buyer and can help you negotiate a higher price.

If you choose to remain with the company, your day-to-day reality will differ greatly depending on the type of buyer.

Private Equity Operations

You’ll also face intense goals for both growth and profitability. PE funds aim for strong returns when they eventually resell the company, so they prioritize pushing performance metrics hard—often with limited additional resources.

PE owners may leverage their network to bring in new hires they believe will optimize performance. While these additions can be helpful, they may also create political challenges regarding loyalty and alignment. Another common PE strategy is pursuing add-on acquisitions to expand market presence and product offerings.

Finally, PE ownership typically involves synergy plays, which can mean consolidating or eliminating redundant roles. Although you might keep a leadership position, major decisions now involve a new partner’s input, reducing the autonomy you once enjoyed.

Strategic Buyer Operations

You’ll likely be tasked with identifying synergies, such as integrating product lines or merging teams. If the acquirer already has its own DevOps or support staff, they might phase out your existing teams. You may also work with their sales leadership on cross-selling initiatives, which can offer broader reach but typically comes with new reporting lines and procedures.

A significant downside for many founders is the loss of autonomy. While a PE owner might still let you drive day-to-day strategy (under watchful supervision), a strategic acquirer typically absorbs you into its hierarchy. You become part of a larger corporate structure where major decisions must follow established processes.

In Conclusion

If you’re thinking about selling your B2B SaaS, it’s crucial to prepare thoroughly, understand your potential buyers, and consider what life after the sale will be like—both personally and professionally. While the financial rewards can be substantial, the emotional and strategic ramifications are equally significant.

Whether you choose to stay on after the sale or venture into new territory, a successful exit requires clear objectives, realistic expectations, and a strong support team to guide you through the complexities of the deal. Building a B2B SaaS is both challenging and rewarding; by doing your homework and planning ahead, you can maximize the chances of an outcome that benefits you and your company’s future.