Founders & CEOs often hold tightly to their vision of taking their companies public through an IPO. This aspiration is rarely discouraged by VCs, who are driven by the pursuit of exceptional success stories to sustain their returns. This dynamic, however, can lead to less-than-ideal outcomes.

The situation becomes more complex considering that during 2021, many of these companies secured substantial funding at extremely high valuations. In several instances, these companies’ current market valuations have fallen below the total capital they have raised, creating a scenario where financial gains are possible only if they achieve exceptional growth before their funds deplete.

Executive teams are thus faced with a high-stakes decision: to either rapidly increase growth or risk failure. This approach signifies a desperate push for growth, as failure to achieve this means either no profits or the necessity to sell off the company cheaply.

Given the ongoing slowdown in revenue growth in the software industry, the coming year is perceived as a critical window to demonstrate significant growth to convince VCs of their continued investability. While the situation may seem dire, there are strategies to navigate these challenges to optimise potential outcomes in any given scenario.

Scenario Planning

Companies are currently grappling with strategic decisions, constrained by limited cash reserves, challenging venture capital (VC) fundraising conditions, and a pressing need to demonstrate their viability for investment.

They’re debating several strategies:

- Pursuing aggressive sales and hoping for success to attract investors.

- Cutting spending significantly to extend their financial lifespan, which might hinder growth and investment attractiveness

- Finding a middle ground between these two approaches.

There’s considerable pressure to choose the first option, based on the belief that without substantial growth, securing additional VC funding is unlikely, leading either to the company’s demise or its cheap sale. This strategy, while risky, aligns with aspirations for an IPO, despite the reality of challenging market conditions and previous fundraising rounds. For software companies, reaching a certain revenue level offers some resilience, but financial returns may still be compromised due to past fundraising and the current economic climate.

Scenario Frameworks

Acquisitions present a highly profitable exit strategy, though they come in various forms with differing outcomes. For example, strategic acquisitions, especially in the growing AI sector, differ markedly from private equity acquisitions. The latter, while beneficial, are rarely the primary objective and pose challenges for companies with previously inflated valuations.

Key strategies for companies include:

- Striving to be ‘default investable’

- Achieving ‘default alive’ status

- Considering strategic acquisitions

- Exploring private equity acquisitions

Achieving the Status of Default Investable

For most VC-backed software companies, a primary goal is to become “default investable.” This term, introduced by David Sacks, refers to a company whose performance metrics are robust enough to secure additional financing in any market conditions.

A key factor in being default investable is revenue growth. The growth rate needed varies depending on the stage of the company and is somewhat variable, given the current widespread stagnation in growth.

Investors look for a combination of growth and efficiency in a company. Here, efficiency implies not just positive cash flow, but also strong software unit economics.

Attaining Default Alive Status

Paul Graham introduced the concept of “default alive,” which describes a company’s capability to operate without needing external funding. It implies a trajectory towards positive cash flow, not necessarily current profitability.

For companies, especially those in early stages who secured funding during 2020-2021, achieving this status can lead to being labeled as a “zombiecorn.” This term refers to companies with high valuations that are operational but lack vitality in terms of investment attractiveness or employee equity returns, mainly due to slow growth or excessive cash burn.

Companies striving for default alive status after raising substantial funds at high valuations may find their stocks undervalued, turning the business into a lifestyle venture for the leadership.

However, a rare breed of companies that manage to be cash flow positive with rapid growth stand out as both default alive and highly investable.

Strategic Acquisition Explained

In strategic acquisitions, the acquiring entities, often competitors or businesses in related fields, seek out companies whose products or services can seamlessly integrate with their own, enhancing overall value beyond the sum of their separate operations. The objective is to achieve synergistic effects, essentially aiming for the outcome where the combined entity is more significant than its parts. Sometimes, the motive is also to maintain or strengthen their market position.

Private Equity Acquisitions in the Software Sector

Private equity (PE) firms are particularly drawn to software companies due to their consistent revenue, scalability, and potential for high-profit margins. When these firms acquire a software company, their goal is typically to exit the investment in approximately five years, give or take two.

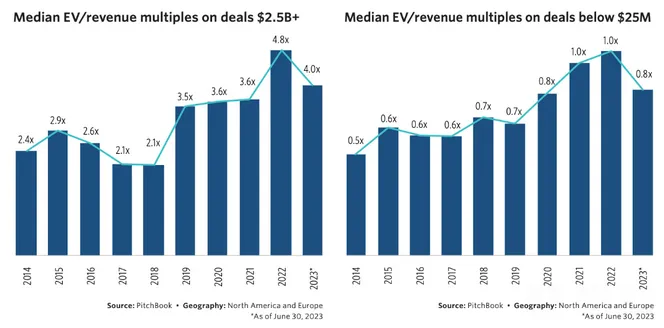

PE acquisitions are focused on companies with certain characteristics: stable revenues, high gross margins, and moderate to low revenue growth – qualities that make them less attractive to venture capitalists. The companies targeted by PE firms generally receive lower valuation multiples. Therefore, software companies with significant funding at high valuations may find PE acquisition a less favorable financial outcome, with tech company PE deals often seeing median multiples around 4.9x.

The Key to Success: Efficient and Rapid Growth

For companies, especially in the tech sector, the aim should be rapid growth coupled with operational efficiency. While this might sound straightforward, it’s a common stumbling block. Many businesses fall into the trap of setting ambitious growth targets based on projections, which often leads to unmet sales goals, unchanged costs, and consequently, a drastic decrease in efficiency and increased cash burn, leading to a state termed as “default dead.”

Balancing Growth and Efficiency

The challenge lies in balancing ambitious growth with maintaining efficiency. Software companies have the advantage of numerous metrics to gauge the sustainability and efficiency of their revenue growth. The optimal balance varies based on the company’s stage, market strategy, industry, etc. Finding this balance is crucial as it determines the company’s value in all potential outcomes.

Reflecting on a thought by VC Paul Graham, success in startups is often more an outcome of growth rather than the cause. Simply increasing staff and spending in the hope of accelerating growth doesn’t necessarily yield the expected results. If growth is slow despite these efforts, it leads to dwindling cash reserves and plummeting efficiency – a default dead situation.

However, when growth and efficiency are appropriately balanced, even if revenue is slightly lower, the efficiency gains are significantly higher, leading to the best possible outcomes for the company.